Terrorist financing involves the collection, movement, and disguising of money in order to finance terrorist operations.

Terrorist activities can be financed from both legal and illegal sources – from political donations, to trading digital currencies, to proceeds of crime, e.g., kidnapping for ransom and fraud, and terrorist financiers often exploit intermediaries in the legitimate economy to hide their illicit activities (think financial institutions, charities, religious organisations, and other shell companies).

Because terrorist financing can be hard to detect, and money can pass through many hands and several territories before reaching its final destination, it’s important that organisations train their employees on how to spot signs of potential terrorist financing and also how to report any suspicious activity they come across whilst being vigilant.

Anti-terrorist financing procedures are often thought-of alongside anti-money laundering practices since the techniques used by terrorist financers to disguise and move money around are closely related to money laundering techniques and sometimes involve actual money laundering.

The signs and red flags for terrorist financing therefore overlap with money laundering red flags, so it’s important to offer training to employees in both subjects alongside your anti-money laundering modules.

What constitutes a terrorist financing offence?

Terrorist financing is any form of financial support for terrorism, terrorist organisations, or anyone encouraging acts of terrorism. This includes direct funding as well as the processing of funds intended to facilitate terrorist operations.

Regulations and legislation criminalise the direct funding of terrorism, as well as activities that can contribute to terrorist financing. While specific definitions of terrorist financing offences vary by jurisdiction, they generally include:

- Knowing or having a reasonable suspicion that fundraising money or property may be used for terrorism. This may include making payments, giving loans, inviting others to make payments, or receiving payments that may be used to fund terrorism.

- Using or acquiring money or other property for terrorist purposes or with reasonable suspicion that it will be used for terrorist purposes.

- Entering into an agreement intended to make money or other property available to another person if it will or may be used for terrorist purposes.

- Facilitating retention or control of terrorist property in any way. This might be on behalf of another person, by concealment, through moving it out of the jurisdiction, or via transfer.

- Failing to report red flags, suspicions, or knowledge of terrorist financing activity.

- Alerting a person or organisation that they are under suspicion or investigation for terrorism-related activities. This is known as tipping off.

The importance of due diligence

Client/customer due diligence (CDD) is a key element of the anti-money laundering (AML) and counter-terrorist financing regime.

Performing proper due diligence should uncover any stakeholder who has a controlling influence on a customer or supplier and who benefits from that account or organisation. These stakeholders are known as ultimate beneficial owners (UBOs).

Since those involved in terrorist financing may not be known to authorities or belong to a terrorist organisation, and since UBOs may not be listed as a legal owner and may be hidden behind layers of ownership, terrorist financers often channel money to hidden UBOs who turn out to be terrorists or other sanctioned entities.

This is exactly why the importance of customer and supplier due diligence checks is emphasised in the fight against terror.

The three component parts of customer/supplier due diligence are as follows:

- Identifying the client or supplier, unless the identity of that client/supplier is already known to you and has been verified by you

- Verifying that identity (unless the client’s/supplier’s identity has already been verified by you)

- Assessing and (where appropriate)gathering more information on the purpose and intended nature of the business relationship or occasional transaction

Due diligence is required whenever a new business relationship is established or where organisations carry out odd/occasional transactions.

It is also good practice to carry out additional due diligence (and report!) if you suspect money laundering or terrorist financing is taking place, or if you doubt the veracity or adequacy of documents or information previously obtained for the purposes of identification or verification

Find out more about due diligence.

Red flags of potential terrorist financing activity

Being able to spot and report warning signs of potential terrorist financing activity is an essential component in stopping the flow of terrorist funds, protecting your organisation, and maintaining national security.

In order to remain compliant with anti-terrorist directives, employees should look out for the following red flags:

- Unknown source of funds

- Funds transferred from a jurisdiction subject to sanctions or increased monitoring

- New accounts with more than one signatory in different locations and there is no apparent connection between the signatories

- Address changes, particularly involving a sanctioned jurisdiction

- Transactions do not match the wealth of the account holder

- High volumes of low-value cash transactions or ATM withdrawals

- Transfer destination in a jurisdiction subject to sanctions or increased monitoring

- Evasiveness, e.g., reluctance to provide information when requested or provision of vague or unsatisfactory explanation for unusual account activity

- Suspicious purchases, including purchase of weapons or materials that may be repurposed to build weapons, sudden trade in high-risk assets such as gems, precious metals, or high volumes of cash, or other uncharacteristic high-risk purchases

- Inaccurate or incomplete information and documentation

- Inconsistencies in information, including seemingly innocent typos

- Inconsistent or insufficient due diligence on suppliers farther upstream in the supply chain

- Negative media exposure that suggests links to terrorism Negative media exposure that suggests links to money laundering or other financial crime

- Customer or supplier screening result suggesting a link to terrorism or financial crime

International sanctions

Terrorists and terrorist organisations are often subject to international sanctions. Sanctions are restrictions imposed on individuals or legal entities (otherwise known as targets) to restrict access to financial services, funds, or economic resources. For example, terrorist organisations such as Al-Qaeda as well as individual Al-Qaeda operatives appear on international sanctions lists.

Different jurisdictions maintain their own sanctions lists. It is therefore important to screen customers and suppliers against your organisation’s consolidated list, which will include sanctioned entities from all jurisdictions where you operate.

How to report suspicious or unusual activity

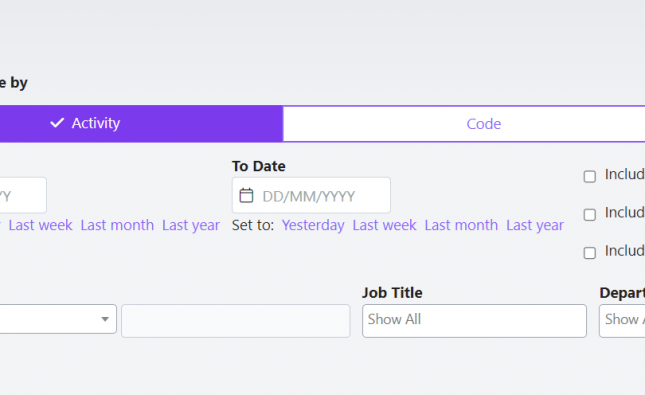

Your organisation should have a procedure for internal reporting of red flags and other suspicious activity. These reports are commonly known as suspicious activity reports (SARs), suspicious transaction reports (STRs), or unusual activity reports (UARs).

It’s the Money Laundering Reporting Officer (MLRO)’s – or other nominated officer’s – responsibility to determine whether further action is required and whether the report is escalated to the authorities.

Some organisations have a special form to fill in for reporting suspicious activity, whilst others permit reports to take any form such as an email, a phone call, or a face-to-face meeting. Always use the method required by your organisation (and if more than one is offered, choose whichever you are most comfortable with).

Regardless of the format, reporting suspicious activity is a confidential process. Only share report details with colleagues who need the information to do their job, and never tip off a customer or supplier that a report has been submitted about them – this is a criminal offense!

If you are ever unsure how to report a suspicion or whether an activity is suspicious, seek advice from your manager. Your organisation’s nominated officer or MLRO can also advise whether a report is needed.

The important thing to remember is that failure to report a red flag or other suspicious activity is illegal, so you must never ignore it. If something doesn’t seem right, seek additional information, get advice, or submit a report.

Need more information?

We hope this article has helped our readers understand what terrorist financing is and how to help prevent it taking place at your organisation. If you need help training your employees on anti-money laundering and anti-terrorist financing best practices, feel free to drop our friendly team a line via email or on 01509 611019. We’re a friendly bunch and would be more than happy to help!

Click here to view our updated for 2022 anti-money laundering collection of eLearning courses!