DeltaNet is now VinciWorks.

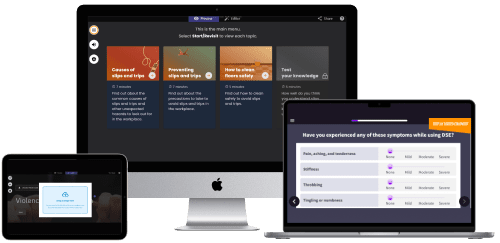

DeltaNet has joined VinciWorks. This means you can now enjoy hundreds more courses covering an increased range of topics, new features such as in-browser edit mode, and more. Existing clients will continue to benefit from all the features they were already enjoying.

You can now enjoy:

- Over 800 courses

- In-browser edit mode

- Global training

- Full accessibility

- Video courses

- Training for specific industries and roles

Contact Us

“The merging of DeltaNet into VinciWorks means we are able to offer more topics, increased development resources and even better customer service to all clients. Our courses are also now available in multiple formats, from video-based courses and five-minute knowledge checks to in-depth training.”